ANTIGUA & BARBUDA CITIZENSHIP BY INVESTMENT PROGRAM

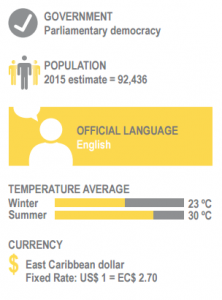

ABOUT ANTIGUA AND BARBUDA

SOCIAL BENEFITS

• Visa-free access to more than 130 countries including Canada, UK, Europe, Hong Kong and more.

• Economically, legally and socially stable country part of the British Commonwealth with democracy based on British parliamentary system.

• Dual citizenship is allowed.

• No tax on worldwide income. No estate, death, inheritance or capital gains tax.

• No restriction on the repatriation of profits and capital.

• Off-shore bank accounts, investments, and companies give unique opportunities for business and tax planning.

• Antigua is the travel hub of the region with direct flights to London, New York, Miami, Toronto and Montreal.

• Home to the most technologically advanced hospital in the Caribbean and two American medical universities.

• Independent country and one of the most sought after destinations in the Caribbean.

ABOUT THE CIP

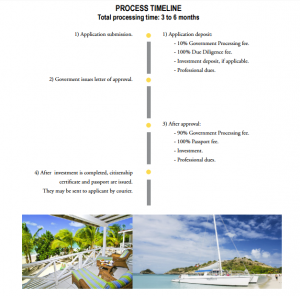

In 2013, the Government of Antigua and Barbuda created a Citizenship by Investment Program (CIP) to attract investors of good character. Investors who make a substantial investment in Antigua and Barbuda qualify to obtain citizenship and passport of the country.

REQUIREMENTS:

• The principal applicant must be at least 18 years old.

• Applicants must choose one of the following investment options: – Minimum US$200,000 (for family of 4 or less) or US$250,000 (for family of 5 or more) non-refundable contribution to the National Development Fund (NDF). – Minimum USD $400,000 in a Government-approved real estate project (held for at least 5 years). – Minimum US$400,000 in a Government-approved business.

• To qualify as dependents, applicants must be: – Children under age 18; or – Children, aged 18-25, who are full-time students, unmarried and dependent on their parents; or – Childer, aged 18 and over who are living with (and fully supported by) the applicant due to physical or mental disability – Parents or grandparents of the principal applicant or spouse may qualify as dependents if they are above 65 years of age and living with the principal applicant.

• Applicants must undergo a medical examination, due diligence verification, and have no criminal record.

• Applicants must spend at least 5 days in Antigua and Barbuda in the 5 years following citizenship issuance.

PROGRAM BENEFITS

Security & Peace of Mind

The social and political life in Antigua & Barbuda is stable and very appealing. It is a member of the United Nations and Commonwealth of Nations.

Freedom of Movement

Access to more than 130 countries without visa, including Canada, United Kingdom, Europe, Singapore, Hong Kong and many more.

Asset Relocation

The secure banking system in Antigua & Barbuda, through many of the international Banks offers a safe place to deposit funds in a tax-friendly jurisdiction.

Tax Advantages

No tax on worldwide income. No estate, death, inheritance or capital gain tax.

Convenience and No Risk

A one-time contribution to the National Development fund makes it easy and risk-free. Passports can then be couriered anywhere in the world making it convenient to the investor.

Simple

There are no minimum net worth, education, language, or management experience requirements to meet.

Luxury & Comfort

Known as the Gem of the Caribbean, Antigua & Barbuda is viewed as a luxury vacation destination.

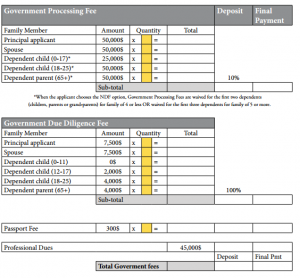

ANTIGUA PROGRAM FEE CALCULATOR